Welcome to Issue 3 of Tax Refresher - International Special Edition!

In this globally focused edition, we spotlight key developments shaping the international tax landscape and the broader business implications for large corporate and international businesses. As tax rules tighten, reporting obligations expand, and global trade dynamics shift, staying informed is more critical than ever.

Here’s what you’ll find in this issue:

Tax trends and economic signals - A strong June for Ireland’s Exchequer

Major Pillar 2 development – G7 and US reach agreement on global minimum tax

International Tax Summit 2025 – Key takeaways from our flagship event on global tax strategy

Compliance Insight – Turning regulatory obligations into business opportunities

Economic commentary – Inflation remains calm but the ECB must remain vigilant

US-UK Trade Deal – New opportunities, ongoing challenges for key industries

Public CbCR – New transparency rules and what multinationals need to know

Post-Brexit VAT trap – The hidden cost of non-ownership in cross-border transactions

Rules of Origin – Practical guidance on navigating global trade rules

EU Tax Reform – Key discussions from the European Parliament’s Subcommittee on tax matters

VAT and Customs – HMRC’s plans to simplify compliance procedures

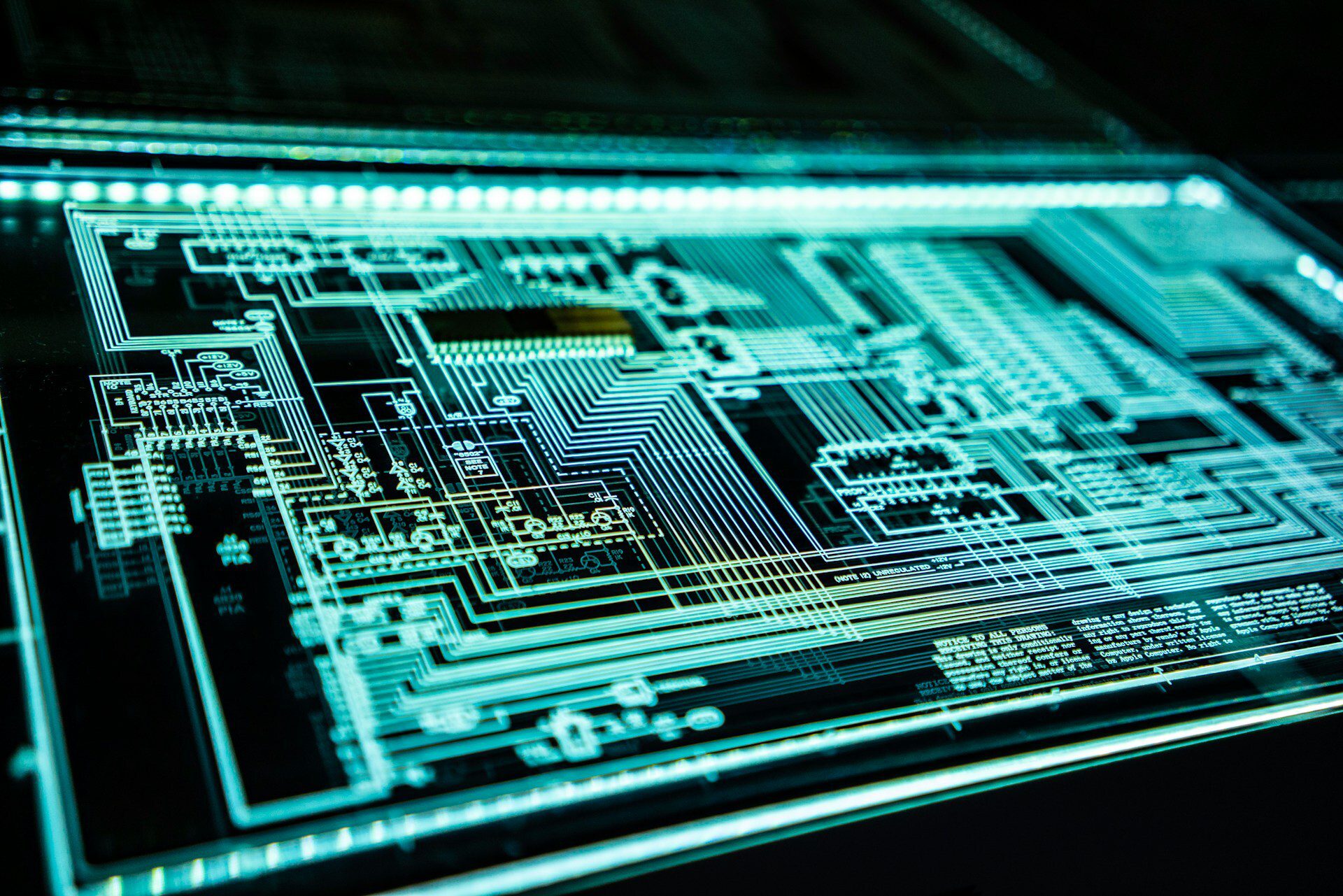

In our BTI Spotlight, we explore how organisations can harnass agentic AI to transform business process optimization.

For any questions or further assistance, reach out to Brendan Murphy.

Stay informed, stay compliant, and stay ahead with Tax Refresher.

Tax trends and economic signals: A strong June for Ireland’s Exchequer

Ireland remains in a strong Exchequer position, notwithstanding the macro policy shifts at global level. From 2014 to 2024, corporation tax receipts grew from €4bn to almost €30bn, excluding the Apple tax windfall. Concerns remain over the policy environment. However, the true impact on the Irish exchequer, if any, is unlikely to be seen until 2026 when most companies will make their payments relating to 2025.

Insights